Top Tools to Combine with Riskify for Advanced Risk Mitigation

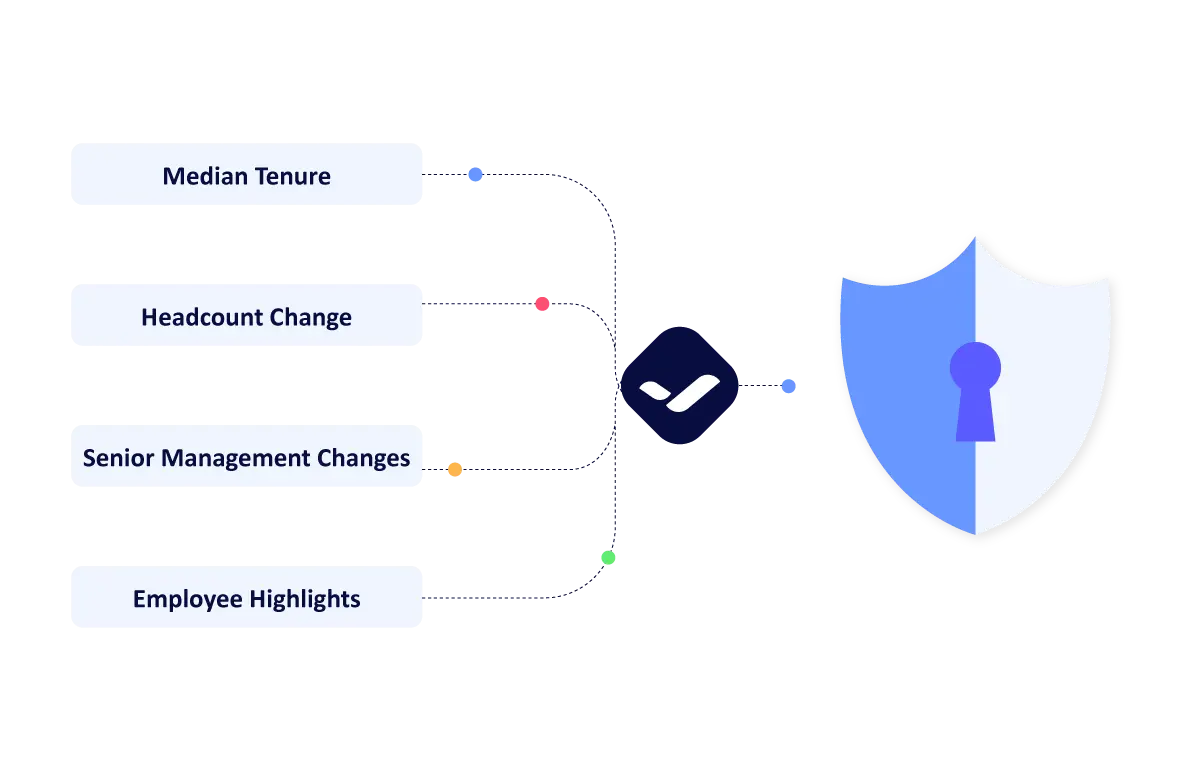

Riskify empowers you to tackle risks with precision, but combining it with complementary tools can elevate your risk management strategy. By integrating advanced solutions, you gain a multi-layered defense against threats like payment fraud, account takeover, and high-risk transactions. These tools enhance Riskify’s real-time decisioning and risk analysis capabilities, ensuring seamless identity verification management and financial security. Whether you’re managing a digital payment platform or navigating transaction risk management, leveraging these integrations helps you stay ahead of fraudulent activities while streamlining automated chargeback management for better chargeback control, particularly in the realm of cybersecurity.

Key Takeaways

Integrating tools like Tableau and Power BI with Riskify transforms raw data into actionable insights, enhancing decision-making and proactive risk mitigation.

Combining Riskify with cybersecurity tools such as Splunk and CrowdStrike strengthens your defense against threats, ensuring real-time monitoring and response to potential fraud.

Utilizing compliance tools like LogicGate and VComply alongside Riskify helps streamline compliance management, ensuring adherence to industry regulations with minimal effort.

Incident management tools like PagerDuty and ServiceNow, when integrated with Riskify, enable swift responses to risks, minimizing downtime and maintaining operational continuity.

Predictive analytics tools such as SAS and IBM Watson enhance Riskify's capabilities by providing advanced forecasting, allowing businesses to anticipate and address risks proactively.

Choosing the right complementary tools to integrate with Riskify is crucial; align your business needs with the specific functionalities of each tool for maximum efficiency.

Leveraging these integrations not only strengthens your risk management strategy but also empowers your organization to act quickly against potential threats.

Data Analytics and Visualization Tools

Data analytics and visualization tools play a vital role in enhancing your risk management strategies. By combining these tools with Riskify, you can transform raw data into actionable insights, enabling better decision-making and proactive risk mitigation.

Tableau

Key features of Tableau for risk data visualization

Tableau stands out as a leading data visualization tool, offering intuitive dashboards and interactive charts. It allows you to process large datasets quickly and present them in a visually appealing format. With its drag-and-drop interface, you can create custom visualizations that highlight trends, anomalies, and patterns in your risk data. Tableau’s ability to handle real-time data ensures that you stay updated on potential threats and opportunities.

"Tableau empowers users to see and understand their data, making it an essential tool for businesses aiming to stay ahead of risks."

How Tableau integrates with Riskify to provide actionable insights

When integrated with Riskify, Tableau enhances your ability to analyze non-financial risks such as operational inefficiencies and compliance gaps. Riskify’s AI-driven insights feed directly into Tableau, allowing you to visualize risks in real time. For example, you can monitor employee turnover rates or compliance metrics through dynamic dashboards. This integration helps you identify fraudulent activities and streamline your ecommerce fraud prevention efforts. By combining Tableau’s visualization capabilities with Riskify’s robust risk assessments, you gain a comprehensive view of your organization’s risk landscape.

Power BI

Benefits of using Power BI for risk analysis

Power BI offers a powerful solution for analyzing and interpreting risk-related data. Its user-friendly interface and advanced analytics features make it ideal for identifying vulnerabilities and predicting potential threats. Power BI supports seamless data integration from multiple sources, enabling you to consolidate information for a holistic view of risks. Its machine learning capabilities further enhance your ability to detect patterns and forecast outcomes.

"Power BI transforms complex datasets into meaningful insights, helping businesses make informed decisions."

Use cases for combining Power BI with Riskify

Integrating Power BI with Riskify unlocks new possibilities for risk analysis. Riskify’s real-time insights on cybersecurity, compliance, and operational risks can be visualized and analyzed within Power BI. For instance, you can track payment fraud incidents and assess their impact on your platform’s performance. Additionally, Power BI’s predictive analytics can complement Riskify’s AI-driven assessments, enabling you to anticipate risks and take preventive measures. This combination also aids in chargeback management by providing detailed reports and actionable insights.

Cybersecurity and Threat Detection Tools

Cybersecurity remains a critical aspect of risk management. Integrating advanced threat detection tools with Riskify strengthens your ability to identify and mitigate risks effectively. These tools enhance your defense against fraudulent activities, ensuring your platform remains secure and resilient.

Splunk

Overview of Splunk's threat detection capabilities

Splunk Enterprise Security is a powerful solution designed to provide comprehensive threat detection and response capabilities. It excels in monitoring and analyzing vast amounts of data in real time, helping you uncover hidden vulnerabilities and potential threats. Splunk’s robust features include anomaly detection, user behavior analytics, and advanced reporting. These capabilities allow you to stay ahead of cybersecurity challenges by identifying risks before they escalate.

"Splunk empowers organizations to transform data into actionable intelligence, making it an indispensable tool for modern cybersecurity strategies."

How Splunk complements Riskify in identifying and mitigating cyber risks

When paired with Riskify, Splunk enhances your ability to combat cyber risks. Riskify’s AI-driven insights feed seamlessly into Splunk’s analytics engine, enabling you to monitor and respond to threats in real time. For instance, you can track unusual login patterns or detect anomalies in transaction data, which helps prevent ecommerce fraud. This integration also supports automated workflows, allowing you to streamline incident response and reduce downtime. Together, Splunk and Riskify create a robust cybersecurity framework that protects your platform from fraudulent activities and ensures operational continuity.

CrowdStrike

Key features of CrowdStrike for endpoint protection

CrowdStrike specializes in endpoint protection, offering cutting-edge features to safeguard your systems. Its cloud-native architecture enables rapid deployment and scalability, while its AI-powered threat intelligence detects and neutralizes advanced cyber threats. CrowdStrike’s capabilities include malware prevention, real-time monitoring, and proactive threat hunting. These features ensure your endpoints remain secure, even against sophisticated attacks.

"CrowdStrike redefines endpoint security by combining speed, intelligence, and precision to deliver unmatched protection."

Integration benefits with Riskify for advanced threat management

Integrating CrowdStrike with Riskify provides a comprehensive approach to advanced threat management. Riskify’s real-time risk assessments complement CrowdStrike’s endpoint protection by offering insights into potential vulnerabilities. For example, you can use CrowdStrike to monitor endpoint activity while leveraging Riskify to assess the broader impact of detected threats. This combination enhances your ability to prevent data breaches, mitigate risks, and maintain a secure environment. Additionally, the integration streamlines chargeback management by reducing the likelihood of cyber incidents that could lead to disputes.

Compliance and Regulatory Tools

Compliance and regulatory tools are essential for maintaining adherence to industry standards and legal requirements. By integrating these tools with Riskify, you can strengthen your compliance strategies and ensure a seamless approach to regulatory risk management.

LogicGate

Features of LogicGate for compliance management

LogicGate offers a dynamic platform designed to simplify compliance management. It provides customizable workflows that allow you to tailor processes to meet specific regulatory requirements. With its intuitive interface, you can automate repetitive tasks, track compliance activities, and centralize documentation. LogicGate also includes advanced reporting features, enabling you to generate detailed compliance reports for stakeholders and regulators. These capabilities help you maintain transparency and accountability across your organization.

"LogicGate empowers businesses to streamline compliance processes, reducing complexity and enhancing operational efficiency."

How LogicGate enhances Riskify's regulatory risk mitigation

When paired with Riskify, LogicGate creates a powerful compliance solution. Riskify’s real-time risk assessments integrate seamlessly with LogicGate’s workflows, providing you with actionable insights into regulatory risks. For example, you can monitor compliance gaps and address them proactively using LogicGate’s automated alerts. This integration ensures that your organization stays aligned with evolving regulations while minimizing the risk of non-compliance. Together, LogicGate and Riskify enable you to build a robust framework for managing regulatory challenges effectively.

VComply

Overview of VComply's compliance tracking capabilities

VComply excels as a governance, risk, and compliance (GRC) platform, offering tools to centralize and streamline compliance activities. It features a pre-built regulatory framework library, which simplifies the alignment of compliance efforts across your organization. VComply also provides continuous access to the latest regulatory content, ensuring that your operations remain up-to-date. Its customizable dashboards and detailed reporting enhance visibility, allowing you to track compliance metrics and communicate statuses to stakeholders with ease.

"VComply transforms compliance management by delivering real-time updates and actionable insights, ensuring consistent adherence to regulations."

Use cases for combining VComply with Riskify

Integrating VComply with Riskify enhances your ability to manage compliance risks. Riskify’s AI-driven insights feed directly into VComply’s centralized platform, enabling you to monitor and address compliance issues in real time. For instance, you can use VComply to track audit findings and align them with Riskify’s risk assessments. This combination improves decision-making by providing a holistic view of compliance and risk data. Additionally, VComply’s automated notifications of regulatory changes complement Riskify’s real-time updates, ensuring that your organization remains compliant with minimal effort.

Incident Management and Response Tools

Incident management tools play a crucial role in addressing risks swiftly and effectively. By integrating these tools with Riskify, you can enhance your ability to respond to incidents, minimize downtime, and maintain operational continuity. Let’s explore how PagerDuty and ServiceNow can work alongside Riskify to streamline your risk response strategies.

PagerDuty

Key features of PagerDuty for incident response

PagerDuty offers a robust solution for managing incidents in real time. It provides automated alerts, on-call scheduling, and escalation policies to ensure that the right team members address issues promptly. Its incident lifecycle management capabilities allow you to track incidents from detection to resolution. PagerDuty also integrates seamlessly with other platforms, enabling centralized monitoring and response.

"PagerDuty empowers teams to act quickly and efficiently, reducing the impact of incidents on business operations."

How PagerDuty works with Riskify to streamline risk response

Integrating PagerDuty with Riskify creates a powerful incident response framework. Riskify’s AI-driven insights can trigger PagerDuty incidents automatically, ensuring immediate action when risks arise. For example, if Riskify detects unusual activity indicating potential fraud, PagerDuty can alert your team instantly. This integration keeps incident details synchronized throughout their lifecycle, enabling seamless collaboration. By combining PagerDuty’s real-time engagement with Riskify’s risk assessments, you can address threats proactively and maintain a secure platform.

ServiceNow

Benefits of ServiceNow for risk incident management

ServiceNow excels in managing risk incidents through its comprehensive workflows and centralized interface. It simplifies the process of tracking, analyzing, and resolving incidents. ServiceNow’s intuitive dashboards provide a clear overview of incident statuses, helping you prioritize tasks effectively. Its ability to integrate with other tools enhances operational efficiency, making it a preferred choice for many organizations.

"ServiceNow transforms incident management by providing a unified platform for tracking and resolving risks."

Integration strategies with Riskify for seamless workflows

When you integrate ServiceNow with Riskify, you unlock new possibilities for managing risk incidents. Riskify’s real-time insights feed directly into ServiceNow, allowing you to create and manage incidents without leaving the platform. For instance, Riskify can identify compliance risks or operational inefficiencies, which ServiceNow can then track through its workflows. This integration ensures that your team stays informed and takes timely action. Additionally, ServiceNow’s ability to handle emergency change requests complements Riskify’s risk mitigation strategies, creating a seamless workflow for incident management.

Predictive Analytics and Machine Learning Tools

Predictive analytics and machine learning tools provide you with the ability to anticipate risks and make informed decisions. By integrating these tools with Riskify, you can enhance your risk forecasting capabilities and stay ahead of potential challenges.

SAS Advanced Analytics

Overview of SAS's predictive analytics capabilities

SAS Advanced Analytics offers a comprehensive solution for predictive risk management. It uses intelligent risk analytics to help you identify patterns and predict outcomes. With proven methodologies, SAS enables you to optimize capital, manage liquidity, and meet regulatory requirements efficiently. Its high-performance analytics deliver insights on demand, empowering you to make data-driven decisions with confidence.

"SAS drives business evolution by fostering a risk-aware culture and enhancing transparency in decision-making."

SAS also provides tools to analyze large datasets quickly. This allows you to uncover hidden risks and opportunities. Its focus on efficiency ensures that you can balance short-term needs with long-term strategies effectively.

How SAS enhances Riskify's risk forecasting

When combined with Riskify, SAS takes risk forecasting to the next level. Riskify’s AI-driven insights integrate seamlessly with SAS’s predictive models, enabling you to anticipate risks with greater accuracy. For example, you can use SAS to analyze historical data and predict future trends, while Riskify provides real-time updates on emerging threats. This combination helps you address risks proactively and maintain a competitive edge.

SAS also complements Riskify’s capabilities by offering advanced visualization tools. These tools allow you to present risk forecasts in a clear and actionable format. Together, SAS and Riskify create a powerful platform for managing risks and driving business growth.

IBM Watson

Key features of IBM Watson for machine learning in risk management

IBM Watson leverages cutting-edge machine learning to transform how you manage risks. Its AI-powered algorithms analyze complex datasets and deliver actionable insights. Watson excels in identifying anomalies, detecting fraud, and predicting potential threats. Its natural language processing capabilities also enable you to extract valuable information from unstructured data sources.

"IBM Watson redefines risk management by combining advanced AI with intuitive user experiences."

Watson’s scalability ensures that it can adapt to your organization’s needs. Whether you are managing small-scale risks or tackling enterprise-level challenges, Watson provides the tools to enhance your decision-making process.

Use cases for combining IBM Watson with Riskify

Integrating IBM Watson with Riskify unlocks new possibilities for risk management. Riskify’s real-time assessments feed directly into Watson’s machine learning models, enabling you to detect risks faster and with greater precision. For instance, you can use Watson to analyze customer behavior and identify patterns that indicate potential fraud. Riskify’s insights then help you take immediate action to mitigate these risks.

Watson also enhances Riskify’s capabilities by providing predictive analytics. This allows you to forecast risks and develop strategies to address them before they escalate. Additionally, Watson’s ability to process unstructured data complements Riskify’s structured risk assessments, giving you a holistic view of your risk landscape.

Integrating complementary tools with Riskify transforms your risk management approach into a comprehensive and proactive solution. Each tool discussed enhances specific aspects of risk mitigation, from real-time monitoring to predictive analytics. By combining these tools with Riskify, you gain instant insights and the ability to act quickly against potential threats. This integration strengthens your platform’s resilience and ensures effective compliance management. Start by identifying the tools that align with your business needs and integrate them strategically with Riskify to maximize efficiency and safeguard your operations.

Transform Your Risk Management Today!

Discover how Riskify can enhance your business's risk management strategies with real-time insights and AI-driven assessments.

FAQ

How does Riskify integrate with other tools?

Riskify integrates seamlessly with various tools through its API and data-sharing capabilities. You can connect it to platforms like Tableau, Power BI, or Splunk to enhance your risk management strategies. These integrations allow you to visualize, analyze, and act on real-time risk insights without switching between multiple systems.

Can I use Riskify for compliance management?

Yes, Riskify supports compliance management by providing real-time insights into regulatory risks. When combined with tools like LogicGate or VComply, you can track compliance metrics, address gaps, and ensure adherence to industry standards. This integration simplifies the process of staying compliant with evolving regulations.

What industries benefit the most from Riskify?

Riskify serves a wide range of industries, including finance, e-commerce, and cybersecurity. It is particularly effective for businesses managing digital payment platforms or those requiring advanced transaction risk management. Its AI-driven insights help organizations across sectors mitigate operational, reputational, and compliance risks.

How does Riskify enhance cybersecurity?

Riskify strengthens cybersecurity by identifying potential threats in real time. When integrated with tools like Splunk or CrowdStrike, it provides a comprehensive defense against cyber risks. You can monitor unusual activities, detect fraud, and respond to incidents swiftly, ensuring your platform remains secure.

Is Riskify suitable for small businesses?

Yes, Riskify is designed to be accessible for businesses of all sizes. Its affordable pricing and lifetime deal make it an excellent choice for small businesses. You can leverage its AI-driven insights to manage risks effectively without the need for extensive resources.

Can Riskify predict future risks?

Riskify uses AI to provide predictive insights, helping you anticipate potential risks. When paired with tools like SAS Advanced Analytics or IBM Watson, it enhances your ability to forecast risks and develop proactive strategies. This combination ensures you stay ahead of challenges and maintain a competitive edge.

What makes Riskify unique compared to other risk management tools?

Riskify stands out due to its affordability, real-time insights, and AI-driven capabilities. It simplifies risk assessment by generating detailed reports instantly. Its ability to integrate with other tools further enhances its functionality, making it a versatile solution for comprehensive risk management.

How does Riskify support incident management?

Riskify supports incident management by providing real-time alerts and actionable insights. When integrated with tools like PagerDuty or ServiceNow, it streamlines the process of addressing incidents. You can track risks, assign tasks, and resolve issues efficiently, minimizing downtime and maintaining operational continuity.

Can Riskify handle large datasets?

Yes, Riskify is equipped to process and analyze large datasets efficiently. Its AI technology ensures that you receive accurate and timely insights, even when dealing with complex data. Integrating it with visualization tools like Tableau or Power BI further enhances its ability to handle extensive information.

How do I choose the right tools to integrate with Riskify?

To select the right tools, identify your business needs and risk management priorities. For data visualization, consider Tableau or Power BI. For cybersecurity, explore Splunk or CrowdStrike. Compliance-focused businesses may benefit from LogicGate or VComply. Aligning your goals with the capabilities of these tools ensures maximum efficiency.